On Monday, the Habersham County commissioners adopted the 2025 county millage rate by a vote of 3 to 2. The general fund, hospital bond, and emergency services combined rate has decreased to 13.067 mills from 13.085 mills the previous year.

County officials maintain that the new HB 581 exemption and Habersham’s Homestead Exemption will protect most property owners from tax increases. However, many locals are still concerned about their impending tax bills due to rising property values.

The entire rollback millage rate was approved by commissioners Ty Akins, Dustin Mealor, and Kelly Woodall. It was opposed by Vice-Chair Bruce Harkness and Chairman Jimmy Tench.

What it means for homeowners

According to Interim Finance Director Kiani Holden, a house worth $300,000, which is currently regarded as the county average, will pay roughly $1,352 in county property taxes under the new general fund millage rate of 11.272. That amount is calculated by multiplying the tax rate by 40% of the assessed value, or $120,000.

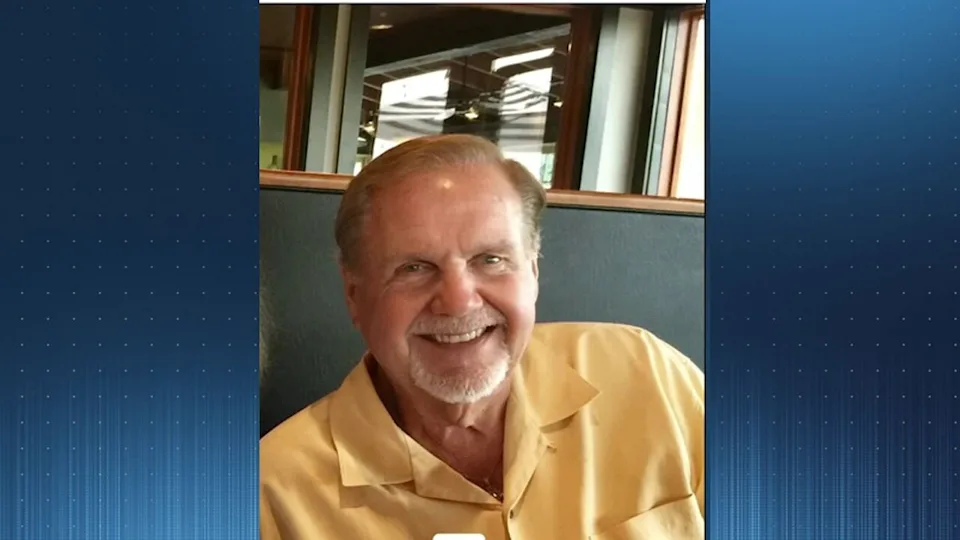

More than 80% of residential properties are shielded from increasing assessments by Habersham’s floating freeze and HB 581 exemption, according to County Manager Tim Sims. According to Sims, unless you made changes to your house that changed its value, most people should be paying the same rate they were in 2022.Kiani Holden, the interim finance director and financial administrator for Habersham County, presents the county’s proposed millage prior to the August 18, 2025, public hearing and vote. (Image from a livestream)

Even though the overall rate decreased, a greater percentage of property owners’ taxes will go toward repaying the hospital bond debt. The county has used up all of the $5 million in SPLOST revenue that voters approved to pay off the debt, which is why that rate increased from 0.757 mills in 2024 to 1.129 mills this year.

Holden clarified that since SPLOST is no longer an option, we must now pay the bond payment in full from property taxes.

County finances and exemptions

According to Holden, exclusions have increased significantly over time, from $221 million in 2016 to $908 million in 2025.

Over the past few years, but particularly in the past year, our exemptions have increased dramatically, Holden stated.

Despite these exclusions, Habersham’s tax digest increased by $151.4 million due to upgrades and new building. The net taxable digest for the county is currently $2.16 billion. Assuming a 98% collection rate, authorities anticipate collecting roughly $23.5 million for the FY 2026 budget at the proposed millage.The trend line illustrates Habersham County’s increase in exemptions from 2016. (Source: Finance Office of Habersham County)

Debate over reassessments

Growing worries over rising assessments were brought to light by the 3–2 decision on the millage rate. The county recruited an outside consulting firm to offer the most recent assessments.

“When I opened that little envelope, my eyes nearly dropped out because most people’s property was so jacked up,” Commissioner Harkness recalled.

Many people question me, “If we’re doing all these calculations to try to keep people’s taxes down, why are we paying a million dollars [to consultants] to jack people’s values up?” “I said.” According to Harkness, the rollback savings are essentially zero.

According to state law, counties must maintain a sales ratio of at least 38.5% or risk a state-imposed reassessment, Sims argued in support of the reassessment. Many commercial and industrial assets have long been undervalued, according to Sims. He clarified that the assessments have not been carried out as proactively as they need to have been for a number of years.

Where the money goes

The school system, which is anticipated to implement its own complete rollback next week, is supported by more than half (50.27%) of Habersham’s entire millage rate. The breakdown of the county portion is as follows:

- 40.98% general fund

- 4.11% hospital bond

- 4.67% emergency services

Public safety receives nearly half of the general budget (18.02%), followed by general government (9.5%), judicial activities (5.06%), and smaller amounts for capital projects, public works, welfare, recreation, housing and development, debt service, and health and welfare.

Votes explained

During the public hearing, no locals expressed support or opposition to the millage rate.

Commissioner Woodall stated that he was in favor of the rollback because it was the wisest course of action as long as we were saving taxpayers and rolling it back as far as possible.

We made a budget cut of $4.2 million. To save the taxpayers the rise they have witnessed in other areas, we have pulled back our spending after making every attempt to limit it. That’s my main worry, and I’m on board if you can reassure me that’s what we’re doing,” Woodall remarked, speaking to Holden.

Holden said, “Yes, of course.”

Citing his displeasure with the outstanding hospital bond obligation, Chairman Tench voted nay. He expressed his worry about the county’s last multi-million dollar bailout of Habersham Medical Center before to its acquisition by Northeast Georgia Health System. Sims responded, “That’s kind of a different subject; it’s not part of the millage rate.”

Longtime residents and those on fixed incomes are reaching a breaking point, Harkness said, as mounting assessments and tax bills make many feel as though they are being priced out of their own neighborhood.

“Every day, I hear from people who have lived here for generations that they can no longer afford to live here because they are being taxed off of their own property,” he said. Therefore, even if we are informed that the millage rate has not increased, our taxes are gradually rising, and someone needs to stand out and demand that this onerous taxation of our population end.