(Recorder of Georgia) On Tuesday, Georgia lawmakers talked about doing away with the state income tax, but they gave few specifics.

The Senate Special Committee on Eliminating Georgia’s Income Tax held its inaugural meeting with assistance from Lt. Gov. Burt Jones, who is running for governor of Georgia.

“We need to be looking for ways to keep us competitive and make it where we have a competitive advantage over states that we are constantly competing with if we want to stay competitive here in the state of Georgia and continue to be the number one state to do business,” Jones stated at the beginning of the meeting.

The committee’s members discussed the objective, which is to increase Georgia’s competitiveness with neighboring states that do not impose income taxes, like Florida and Tennessee, as well as states that are in the process of doing so, such Mississippi and North Carolina.

The Governor’s Office of Planning and Budget estimates that 41.6% of Georgia’s projected revenue for the current budget year, which began on July 1, would come from personal income taxes. That figure increases to little more than 50% of total state revenues when corporate income tax is taken into account, which authorities said will be lowered along with personal income tax.Senator Blake Tillery. (The Georgia Recorder/Ross Williams)

Following the meeting, Danny Kanso, senior fiscal analyst at the Georgia Budget and Policy Institute, expressed his want to review the calculations involved. According to him, removing the income tax would result in a significant tax hike for the majority of Georgia households. The state’s biggest source of funding would have to be replaced, and in order to make up for the shortfall, the sales tax would have to be tripled and extended to new products.

According to Kanso, the plan is a partial solution to an issue that would probably have an impact on the entire state and the economy since it would have to raise taxes on a lot more Georgians than it would lower them.

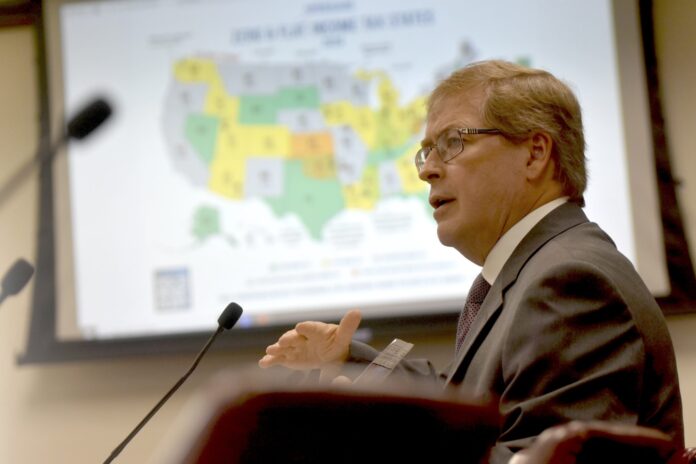

However, Georgia could do away with its 5.19% income tax rate without raising sales tax, according to Grover Norquist, president of Americans for Tax Reform, a conservative group that supports tax cuts. He maintained that since Georgians would have more money to spend if the income tax were abolished, the state budget could still grow thanks to sales tax receipts.

According to Norquist, “you end up with more money for individuals earning it as well as more tax revenue at lower rates when you attract more people, business, and investment into the state.”

According to him, Florida, which does not impose income taxes, generates more revenue each year from sales taxes and other non-increasing levies. Because more people with greater incomes and resources are relocating to Florida, there is more money.

Norquist added that removing the income tax will make Georgia a more desirable state for businesses wishing to relocate their manufacturing, especially in light of the tariffs the Trump administration is putting on other countries to encourage home manufacturing.

Many incentives were implemented by President Trump to encourage foreign investment in the United States. He stated that there are still fifty options.Nan Orrock, Sen. (The Georgia Recorder/Ross Williams)

“Lawmakers are tasked with meeting the needs of our population,” said Sen. Nan Orrock, a Democrat from Atlanta, who questioned how the Legislature could raise money at a time when the federal government is shifting the cost of food assistance and disaster relief programs to the states.

How do you balance cutting state revenue with our state’s needs, the unidentified needs that will arise as K–12 and higher education [and] massive cuts coming from [the federal government]? “Orrock said.”

Norquist cited North Carolina, which has decreased its income tax rate but has continued to spend annually, rather than offering suggestions on how the state may increase revenue.

According to him, it is increasing because revenue is pouring in and they have lowered the marginal tax rates.

Relying on growth is not a practical way to collect $19 billion annually and replace more than 50% of the state budget, according to Kanso, who referred to it as wishful thinking.

“When you hear that we’re going to cut taxes and eliminate revenue sources, and somehow we’re also going to raise more money, it doesn’t really make sense,” Kanso added. We haven’t truly witnessed that work before.