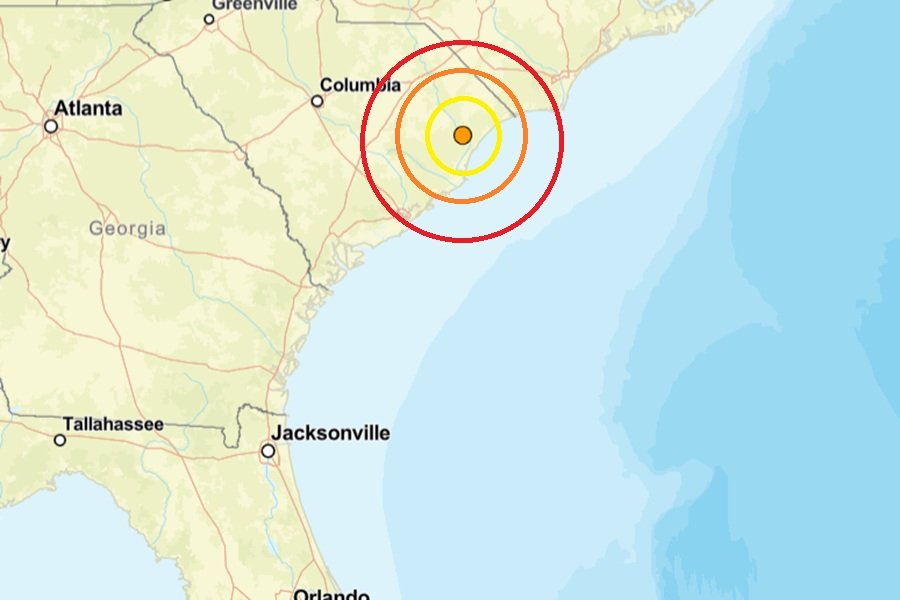

COLUMBIA, SOUTH CAROLINA

— As climate disasters intensify across the U.S., experts warn that the insurance industry may be the first domino to fall in a cascading economic crisis. With more Americans facing canceled policies, unaffordable premiums, and denied coverage, the nation may be barreling toward what one senator called “the next big economic shock.”

Insurers Pull Out Amid Soaring Wildfire and Storm Risk

In wildfire-prone states like California, longtime policyholders like Diane Wolf are being dropped or forced to pay tens of thousands to meet new coverage demands. Wolf, a longtime Berkeley resident, saw her homeowner’s policy with AAA come under scrutiny due to fire risk. The insurer cited issues like an aging roof, uneven sidewalk, and outdoor railing requirements before threatening to cancel coverage.

Even after spending

$60,000 on upgrades

, Wolf only secured minimal coverage. “We were lucky,” she told

Yahoo News

, “but my neighbors were dropped without warning.”

Mortgage Market at Risk if Properties Become Uninsurable

Senate Budget Committee Chairman

Sheldon Whitehouse

recently sounded the alarm during meetings in Florida, warning that the U.S. economy could be shaken if the insurance crisis deepens. He explained that

properties without insurance can’t secure mortgages

, which could spark a broader

property value crash

and economic spiral.

Florida is already feeling the heat. With more than 8,400 miles of coastline and growing storm exposure, Floridians now pay

four times the national average

for homeowners insurance. Premiums have surged by over

40% in the past 18 months

—especially after

Hurricane Ian

, which caused $112 billion in damages and killed 150 people.

Some Americans Are ‘Self-Insuring’—A Dangerous Trend

A growing number of Americans are opting out of insurance entirely. A recent report by the

Insurance Information Institute

found that

12% of homeowners now forgo insurance

, compared to just 5% before the pandemic. But experts say this is a risky gamble.

“Most Americans don’t even have $1,000 in emergency savings,” said

Mark Friedlander

, the institute’s communications director. “How realistic is it to cover hurricane or wildfire damages out of pocket?”

Florida and California’s ‘Last Resort’ Insurers Overwhelmed

With private insurers pulling back, more homeowners are turning to state-run “last resort” insurers like

California’s FAIR Plan

or

Florida’s Citizens Insurance

. But experts warn these systems are being stretched thin.

In Florida, Citizens now covers

1.2 million policies

, holding

18.5% of the entire home insurance market

. If another disaster strikes, the burden could shift to regular auto or life insurance customers—or even the federal government in the form of bailouts.

“Ordinary homeowners will be on the hook for failures in their state’s insurance system,” said

Susan Crawford

, senior fellow at the Carnegie Endowment and a former Obama advisor.

The Bigger Picture: Wildfires, Flooding, and the Cost of Inaction

Climate change isn’t just hitting the coasts. Wildfires, flooding, and intense storms are disrupting housing markets across the country. One storm in

North Carolina dumped 20 inches of rain in a single day

, causing

$7 billion in damages

, according to

AccuWeather

.

In 2023, the

National Oceanic and Atmospheric Administration (NOAA)

tracked

28 separate billion-dollar disaster events

—the highest ever. As temperatures rise, the number and severity of these disasters are expected to increase, pushing insurance markets—and homeowners—to the brink.

Will We Adapt Before It’s Too Late?

Crawford believes the only path forward is to rethink how and where we build. That means incentivizing relocation to safer areas, updating zoning codes, and buying out properties that are likely to burn or flood again. But politically, those ideas face resistance.

“No one has an incentive to change the status quo,” she explained. “Local officials rely on property taxes. Developers want to keep building. But the bill is coming due.”

For now, families like Diane Wolf’s are stuck in the middle—paying more for less protection as insurers retreat from high-risk zones.

“We’ve been getting all these things from industrialization,” added another homeowner,

Steve Swanson

, who opted for a small mobile home after fleeing rising costs on Sanibel Island. “Now it’s time to pay.”

What Do You Think?

Are rising insurance costs affecting your community? Have you been dropped or seen rates skyrocket? Share your experience with the

Saluda Standard-Sentinel

by emailing us directly or commenting below.