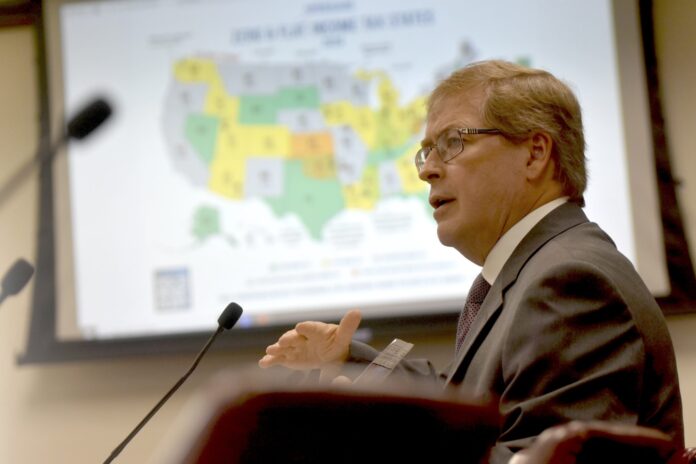

Legislators in Georgia are considering doing away with the state income tax, which would make Georgia the tenth state in the country to do so.

To determine how to phase out the tax, a state Senate research group led by Vidalia senator Blake Tillery, who chairs the Senate Appropriations group, will convene on Tuesday. A comparable committee has been established by the House.

In a recent interview, Tillery told GPB’s Donna Lowry, “We owe this to our taxpayers.” We have too much. We have established a sizable reserve. They have been making payments. Therefore, we must give the money back to the people who originally sent it to us.

According to Tillery, the push extends beyond returning money to taxpayers. He maintained that the goal is to maintain Georgia’s competitiveness with its neighbors. It has been possible for Florida and Tennessee to manage their budgets without paying income taxes. South Carolina and North Carolina are rapidly approaching zero. We must do this as well if Georgia is to remain competitive.

Georgia would be the tenth state to do away with income taxes if lawmakers are successful. It’s already been done by the nine. Tillery stated that we would be on the tenth.

By 2028, the state plans to reduce its flat income tax rate to 4.99%. According to Tillery, stopping there is insufficient. The majority of Georgians, in my opinion, believes that Georgia is the Empire State of the South, so we must compete with our neighbors.

He went on to say that removing the tax would affect choices made by corporations and residents alike. You’ve undoubtedly heard your neighbors say, “Well, I’m just going to live across the line in Florida,” when people are choosing to go to Georgia. Although it’s not exactly that easy, it is when companies are choosing their locations.

Tillery emphasized that the committee’s job is to decide how to do it responsibly, not whether or not to abolish the tax.

I will serve as the chair of the study committee that Lt. Gov. Burt Jones has appointed during the coming months. We will collaborate closely with our Senate colleagues, including Lt. Gov. Jones, to develop a practical and sensible plan for doing away with Georgia’s income tax, he added. It goes without saying that you need to collaborate with your friends and colleagues in the House in order to pass a bill in the Legislature.

Government services like infrastructure, public safety, and education are funded in part by income taxes. Tillery said, “You know, I think we can, and the way that we know we can, is that nine states have already figured out a way to do it,” in response to the question of whether Georgia could exist without that revenue.

He would, however, refrain from speculating about any income adjustments the committee might suggest. I believe it is probably too soon for me to make any assumptions about what the committee will determine. I am aware that my job as chair is not to discuss whether or not the income tax should be abolished. It’s to figure out how to get rid of the income tax.

Before Tillery declared his intention to run for lieutenant governor in 2026, the interview was conducted.

The transcript of an interview on GPB News served as the basis for this story.